Zurich, 4 March, 2014

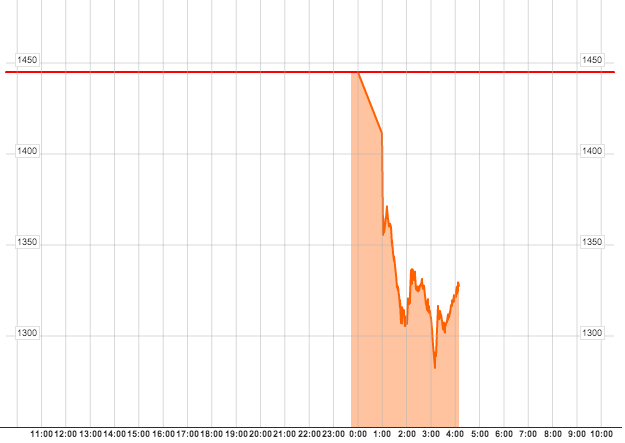

The Central Bank of Russia (CBR) decided to temporarily increase the key rate (1-week repo rate) by 1.5 pp up to 7.0%. The cost of other refinancing instruments will increase accordingly (i.e. FX swaps – up to 8%). The decision came as a surprise to the market although many investors considered a monetary policy tightening after the CBR’s meeting on 14 February as a possible scenario.

The Central Bank of Russia (CBR) decided to temporarily increase the key rate (1-week repo rate) by 1.5 pp up to 7.0%. The cost of other refinancing instruments will increase accordingly (i.e. FX swaps – up to 8%). The decision came as a surprise to the market although many investors considered a monetary policy tightening after the CBR’s meeting on 14 February as a possible scenario.

Emergency measure?

It may be considered as an emergency measure to catch that inflationary risks due to the FX shock (maximum +0.7 pp. to CPI level in 2014) and in order to sustained RUB weakness which could eventually be much higher as the situation with Ukraine is escalating and RUB depreciation has become more acute. This measure should limit RUB depreciation and devaluation expectations. Already today RUB rate was around 36.5/USD and 50.2/EUR despite the fact that during weekend at currency exchange points the rate was RUB 2-3 higher.

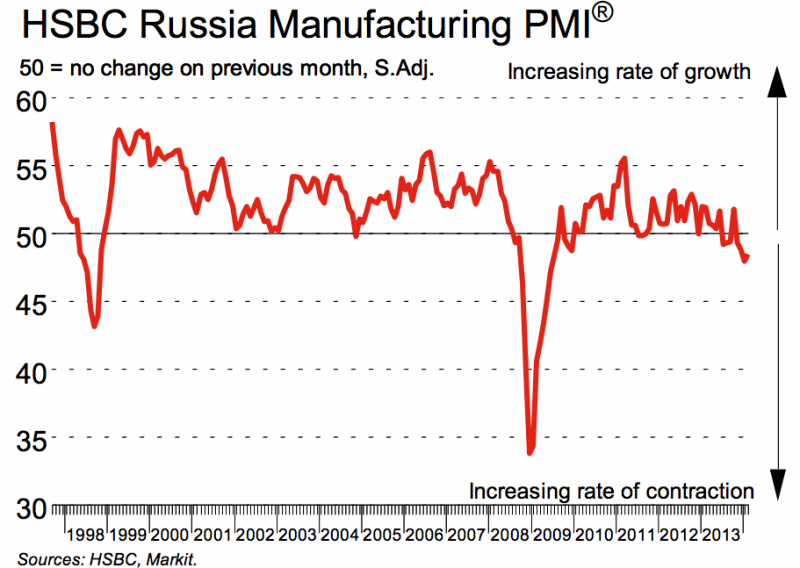

The rouble has been depreciating by almost 10% ytd and 18% yoy. In opposition to mid-last year the rouble seemed to be much more in focus and depreciated stronger in comparison to other emerging markets and other major CEE currencies.

Thus the high pressure on the CBR to tighten policy is continuing despite the sluggish economy. In particular this has been the case since several other pressured central banks among global emerging markets chose to act earlier. The Turkish Central Bank hiked in January effectively by +225bp, while Brazil and South African regulators have been in a strong tightening mode for some time.

Outlook

Given that the Russian FX market is currently driven more by political issues rather than economic ones today’s measure could have a limited effect. With the turmoil around Ukraine to persist for some while and given the lack of clear positive shift in fundamentals we remain short term bearish on the rouble, but would see some appreciation potential from elevated levels if the situation around Ukraine calms down. In the short term the upward pressure on the RUB rates will intensify due to cash outflow (ahead of spring holidays and difficult situation on FX market) as well as the CBR’s interventions.There is a lot of concern about the pressure which this measure could put on the money market and the banking system as a whole. On Monday 3 March, the money market rates are at 7-8% compared to 6.3% at the end of the previous week./RLU