Company’s ViewPick, March 31, 2014

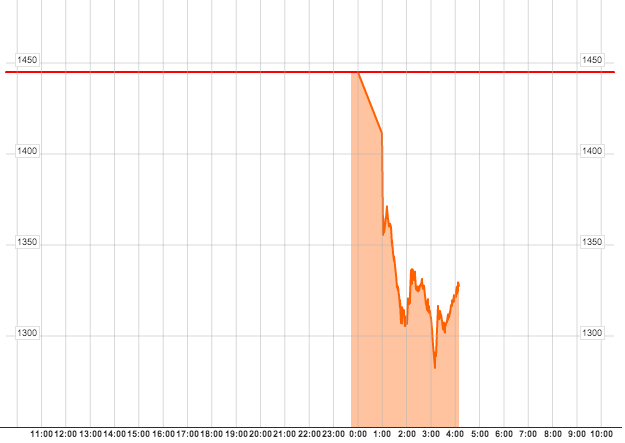

Falling metals’ prices endanger operations

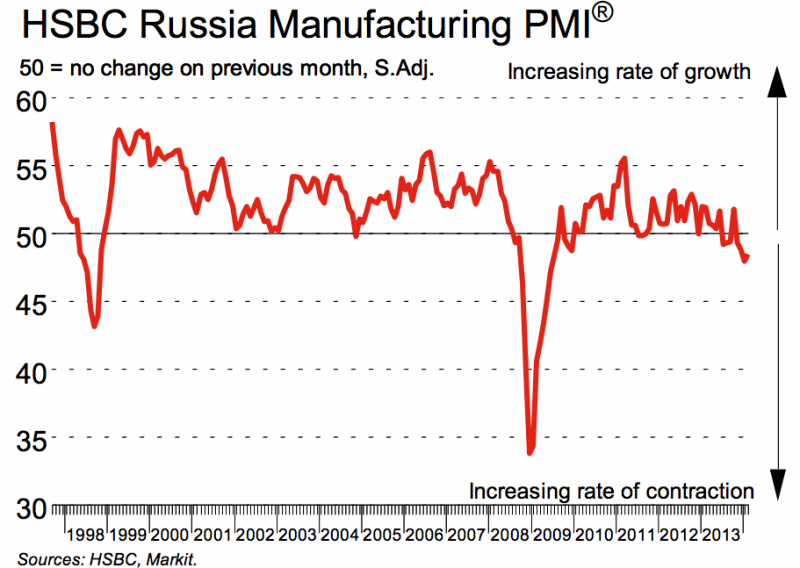

Due to growing sales volume Polymetal posted a 55% half year on half year (hoh) increase in cost of sales which brought gross profit margin to 26% (below the second half year 2012 level). As a result operating profit in second half year (2H) 2013 came at USD 135 mn.

Lower hoh SG&A expenses and TCC helped to post improvement in EBITDA margin to 36.4%: In 2H 2013 Polymetal reduced TCC by 8% hoh to USD 721 per oz GE; the reduction came due to operational improvement at the Albazino-Amursk hub. SG&A expenses also declined and this partly favoured Polymetal to increase EBITDA margin to 36.4% in 2H 2013 from 33.1% in 1H 2013. RLU/ read more Download (PDF) Polymetal RU March 2014 en

Polymetal Conference call notes

- GE production guidance keep on going strategy

- Improvements in TCC will be visible in FY 2014, thanks to completion of ramp-up stages at the key investments projects (Amursk POX, Mayskoye)

- Sharply focus on generation of positive FCF and dividends to continue in FY 2014

- FY 2014 capex will decline yoy as major projects are completed; exploration capex will be maintained

- M&A activities might be on the spotlight as Polymetal looks for possible acquisitions of high quality assets

Polymetal’s management confirmed GE production guidance of 1.3 Moz in FY 2014 and 1.5 Moz in FY 15e. Weakness in the metals’ prices will not affect the company’s production plans. Moreover, due to weakening RUB and completion of the ramp-up stage at Albazino-Amursk POX and Mayskoye Polymetal expects further reduction in TCC, which should positively affect profit margins.

The company does not expect any additional write-offs on impairments/revaluation as the write down made in FY 2013 already took into account weakness in the metals’ prices.

In FY 12014 estimated capex should be reduced to USD 250 mn from USD 319 mn in FY 2013. Polymetal will continue investing in exploration as it targets to extend life of the existing mines, and improve quality of the operations. In FY 2014 Polymetal plans for additions at Albazino-2; Kutyn and Svetloye.

The company’s focus lays on generation of positive FCF and payment of dividends. In FY 2014 Polymetal will continue to generate positive FCF. Net debt/EBITDA should lay within the rate of 1.75 mainly as a result of growing EBITDA (as the company expects to achieve higher cost efficiency).

Considering weak gold and silver prices Polymetal looks for possible acquisitions of high quality assets in FY 2014.

The outlook of Polymetal for FY 2014 promises positive shapes. The company believes in its ability to achieve higher cost efficiency in FY 2014. Despite gold price weakness Polymetal also tries to look for M&A in order to expand its high quality asset portfolio. And it is in the confortable position of having sufficient cash in order to perform M&As. Therefore it will not be a surprise when Polymetal will deliver better financial results in the first half of 2014 after poor results in 2013.